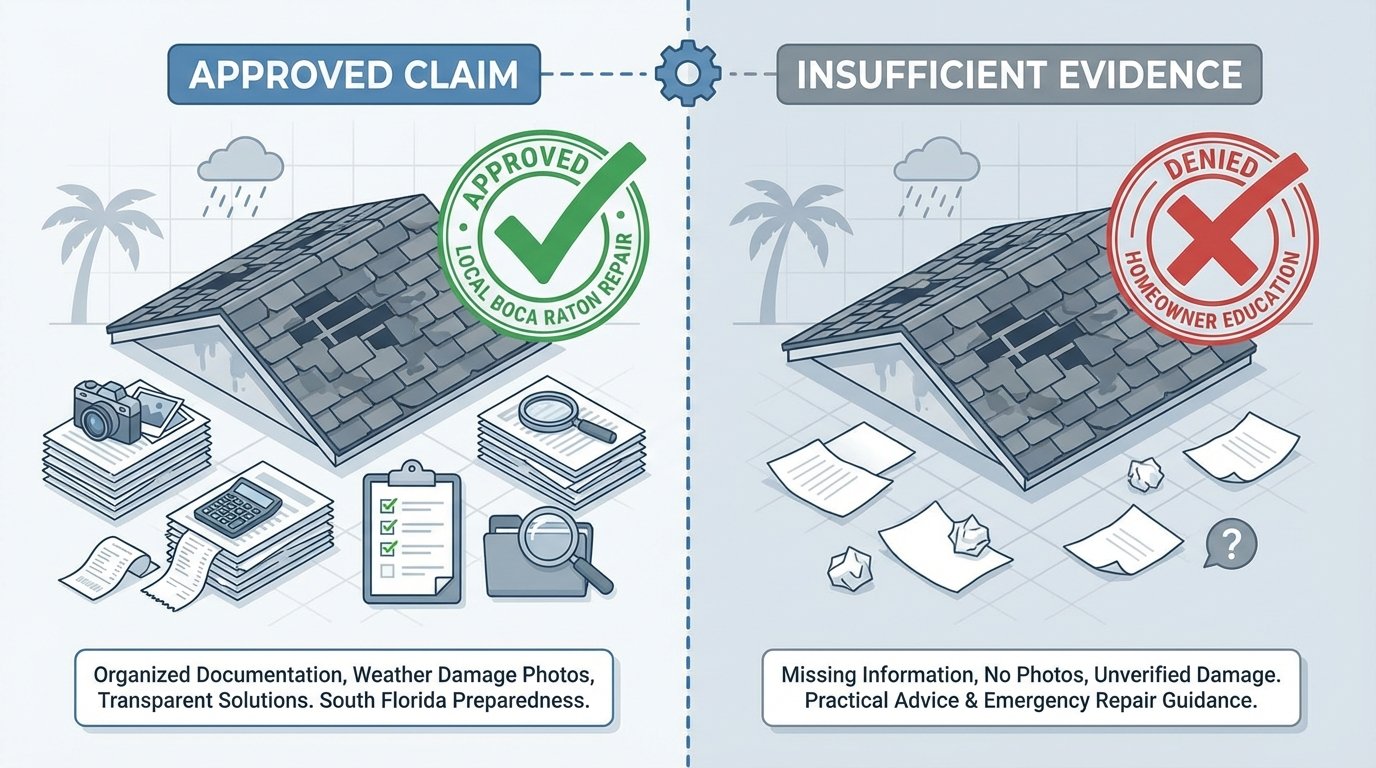

When your roof sustains damage from a storm, fallen tree, or even gradual deterioration, proper documentation can mean the difference between a smooth insurance claim and a denied payout. Most Palm Beach County homeowners discover this the hard way—after their adjuster has already visited and they realize they missed critical evidence that could have strengthened their claim.

The reality is that insurance companies need comprehensive proof before approving roof damage insurance claims, and the burden of documentation falls entirely on you. In my 50+ years running Mike McGilvary Roofing in South Florida, I’ve walked hundreds of homeowners through this process, and the same mistakes keep costing property owners thousands of dollars in denied or reduced claims.

Here’s exactly how to document roof damage for insurance claims the right way—before your adjuster arrives.

Why Documentation Determines Your Claim Outcome

Insurance adjusters handle dozens of claims monthly. They’re not adversaries, but they do work for the insurance company, and their job is to assess damage based on what you can prove—not what you say happened.

Without proper documentation, even legitimate damage gets classified as pre-existing wear, maintenance neglect, or cosmetic issues that don’t warrant coverage. This is especially true in South Florida, where carriers are increasingly scrutinizing roof claims due to Florida’s property insurance crisis.

Strong documentation accomplishes three things:

- Establishes a clear timeline showing damage occurred after a specific event

- Demonstrates the extent and severity of damage throughout your roof system

- Creates a record that protects you if the adjuster’s assessment seems inadequate

Step 1: Document Before Damage Occurs

The strongest insurance claim roof repair cases include “before” photos that prove your roof was in good condition prior to the damaging event.

Take these baseline photos during calm weather:

- Wide shots of your entire roof from ground level, all four sides

- Close-ups of valleys, ridges, and flashing around chimneys and vents

- Interior ceiling photos showing no water stains or damage

- Attic photos showing clean decking and dry insulation

Store these photos with your home documents. If a hurricane or severe storm hits Palm Beach County, these baseline images become invaluable proof that subsequent damage is new—not pre-existing wear that insurance won’t cover.

We provide free roof inspections that include photographic documentation of your current roof condition. Many homeowners use these inspection reports as their baseline documentation, especially when maintaining insurance coverage depends on demonstrating proper roof maintenance.

Step 2: Photograph Damage Immediately After the Event

Once it’s safe to do so, begin documenting damage. Timing matters—document before any temporary repairs when possible, though don’t delay emergency tarping if active leaking threatens interior damage.

Exterior Roof Damage Photos

Never climb onto your roof yourself. Ground-level photos, photos from upper-story windows, and drone footage (if available) provide sufficient documentation without risking injury.

Capture these roof damage photos:

- Overview shots showing the entire damaged area in context

- Missing, cracked, or displaced tiles or shingles

- Damaged or torn underlayment visible where tiles have lifted

- Dented or separated valley metal

- Damaged flashing around chimneys, vents, and skylights

- Lifted ridge caps or hip tiles

- Debris impact points (tree branches, etc.)

- Any visible decking damage where materials have blown off

For each damaged area, take three types of photos: wide shots showing location, medium shots showing extent, and close-ups showing specific damage details.

Interior Damage Documentation

Water intrusion from roof damage creates secondary damage that’s part of your claim:

- Water stains on ceilings and walls

- Bubbled or peeling paint

- Sagging drywall or ceiling materials

- Wet insulation visible in attic spaces

- Water-damaged personal property

- Standing water or active dripping (photo and video)

Document the path water traveled from entry point to affected rooms. This demonstrates the connection between roof damage and interior losses.

Ground-Level Evidence

Don’t overlook debris and materials on your property:

- Roof tiles, shingles, or metal scattered in your yard

- Damaged materials in gutters

- Tree branches or debris that caused impact damage

- Any materials clearly blown from your roof

This evidence proves damage severity and helps establish that significant impact occurred.

Step 3: Video Documentation

Video supplements photos by showing damage scale and relationships between damaged areas. Walk your property’s perimeter recording a continuous narrated video:

“This is the north side of the house after [specific date/storm]. You can see multiple missing tiles in this section, and here’s where water entered causing the interior ceiling damage I’ll show you next.”

Video is particularly effective for demonstrating active leaks, widespread damage patterns, and the overall condition of your roof system.

Step 4: Create a Written Damage Inventory

While filing roof insurance claim paperwork, your written inventory should include:

- Date and time damage occurred (or was discovered)

- Specific weather event or cause (Hurricane, tropical storm, tornado, fallen tree, etc.)

- List of all damaged roof components (tiles, underlayment, flashing, decking)

- Description of interior damage with room-by-room details

- Any emergency repairs made with dates and costs

- Professional assessments or repair estimates obtained

This written record keeps your claim organized and ensures you don’t forget damaged areas when speaking with adjusters.

Step 5: Gather Supporting Documentation

Strong roof damage insurance claims include context beyond just photos:

- Weather reports proving severe conditions occurred on the damage date

- Your roof’s installation date and maintenance records

- Previous inspection reports showing pre-damage condition

- Receipts for any emergency repairs or tarping

- Professional contractor assessments and repair estimates

- Correspondence with your insurance company

We provide detailed inspection reports with annotated photos that insurance adjusters respect. Having a licensed Florida contractor (CCC1331721) document damage carries significantly more weight than homeowner photos alone.

Step 6: Know What Insurance Covers (and Doesn’t)

Understanding coverage limitations prevents frustration and helps you document what actually matters to your claim.

Florida insurance typically covers:

- Sudden storm damage (wind, hail, falling objects)

- Water damage resulting from covered roof damage

- Necessary emergency repairs to prevent further damage

Florida insurance typically excludes:

- Gradual deterioration and wear

- Lack of maintenance

- Cosmetic damage that doesn’t affect function

- Pre-existing conditions

This is where the age of your roof becomes critical. Carriers increasingly deny claims on roofs over 15-20 years old, arguing that damage results from age rather than covered events. Strong documentation showing your roof was well-maintained and damage was sudden becomes essential.

Common Documentation Mistakes That Hurt Claims

These errors weaken otherwise legitimate claims:

Waiting too long to document: Conditions change, temporary repairs cover evidence, and adjusters question why you didn’t act immediately if damage was severe.

Only photographing obvious damage: Secondary damage to flashing, underlayment, and structural components matters just as much as missing tiles. Comprehensive documentation reveals the full scope.

Poor photo quality: Blurry, dark, or poorly framed photos lack credibility. Use good lighting, steady hands, and clear focus.

No reference points: Photos without context make damage scope unclear. Include landmarks, measurements, or common objects for scale.

Accepting the first adjuster assessment: If the adjuster’s evaluation seems inadequate, your documentation becomes the basis for challenging their findings. Without it, you have no leverage.

The Role of Professional Documentation

While homeowner documentation is valuable, professional contractor assessments carry significant weight with insurance companies.

When we inspect storm damage, our reports include:

- Annotated photos identifying specific damage types

- Assessment of hidden damage (underlayment deterioration, decking issues)

- Code compliance evaluation showing what repairs must address

- Detailed repair estimates based on actual material and labor costs

- Professional opinions on whether damage is storm-related or pre-existing

This documentation gives you professional backing when discussing your claim with adjusters. We’ve seen cases where our detailed reports revealed damage the adjuster missed during their initial walk-through—resulting in significantly higher claim payouts.

We provide these inspections at no cost because we want homeowners to understand what they’re actually dealing with, whether that’s a legitimate insurance claim or maintenance issues that require out-of-pocket investment.

What to Do If Your Claim Is Denied or Lowballed

Strong documentation becomes critical when challenging claim decisions.

If your roof damage insurance claim is denied or the payout seems inadequate:

- Request written explanation of the denial or reduced amount

- Review your policy coverage to understand their reasoning

- Obtain independent professional assessments documenting damage

- File a formal appeal with your comprehensive documentation package

- Consider a public adjuster who works for you, not the insurance company

Your detailed documentation—photos, videos, written inventory, professional reports—forms the foundation of any successful appeal.

The Repair vs. Replace Discussion

Once your claim is approved, you’ll face the repair versus replacement decision. This is where many Palm Beach County homeowners get pushed toward unnecessary full replacements.

Insurance may pay for a full replacement, but that doesn’t mean it’s the smartest choice. If you have a 20-year-old concrete tile roof with localized storm damage, a strategic rebuild addressing damaged areas preserves decades of remaining tile life while solving the actual problem.

You don’t buy a new car when you hit 30,000 miles—you replace what needs attention and maintain what’s sound. Your roof works the same way.

A targeted rebuild might include:

- Replacing damaged tiles and underlayment in affected sections

- Rebuilding compromised flashing around penetrations

- Repairing or replacing damaged decking where water intrusion occurred

- Resetting and properly fastening existing tiles to current wind codes

This approach typically costs 20-40% less than full replacement while delivering comparable longevity—and your insurance payout may cover most or all of the work.

Get Professional Documentation Before You Need It

The best time to document your roof is before damage occurs. We provide free roof inspections throughout Palm Beach County that give you baseline documentation, identify potential vulnerabilities, and provide the 5-year roof certifications many insurance carriers now require.

If you’re currently dealing with storm damage, we’ll provide a detailed assessment documenting all damage—visible and hidden—to support your insurance claim. We’re available 24/7 for emergency inspections when severe weather strikes South Florida.

After 50+ years serving Lake Worth, Boca Raton, West Palm Beach, and surrounding communities, we’ve built our reputation on honesty. We’ll tell you what your roof actually needs—whether that’s an insurance claim for storm damage, a strategic rebuild, or simple maintenance—not what generates the biggest invoice.

Contact Mike McGilvary Roofing at [contact information] for a free roof inspection and documentation that protects your property and your insurance claim. We’re locally owned, BBB A+ accredited, and personally involved in every project. Let’s make sure you’re properly protected before the next storm hits.